![[Translate to English:] ntv Focus Money Siegel mit Bestnote 1,4](/fileadmin/_processed_/2/3/csm_Siegel_Note_1_4-03_9d0f1f4137.jpg)

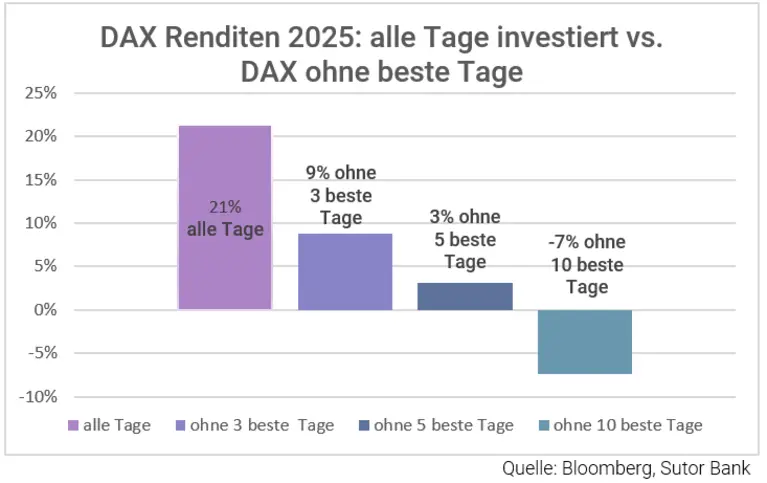

Geopolitical tensions, tariff conflicts and a sometimes erratic transformation of the corporate world through digitalisation and AI: the stock market year 2025 has so far been dominated by many dynamic developments, with some abrupt ups and downs. For asset managers, this means it is even more important to have a clear strategy in order to keep investor portfolios on track. In these times, Hamburg-based Sutor Bank is following the maxim ‘keep calm and stay invested’ – and has once again achieved the top rating and the seal of ‘Outstanding Asset Management’ in the wealth manager test conducted by Focus Money and ntv.

The Institut für Vermögensaufbau (IVA), which was responsible for conducting the test, asked the participating banks and asset managers for advice on an investment amount of between €1.2 and €1.5 million. The institute evaluated the proposals on the basis of a total of seven criteria: comprehensiveness, clarity/understandability, costs, transparency, portfolio structure, product implementation and taxes. Sutor Bank was particularly impressive, receiving a ‘very good’ rating for the criteria of costs and portfolio structure.

Focus on individual securities and ETFs, with silver as an addition

With regard to the basic allocation, Sutor Bank recommends a portfolio consisting of 50 per cent equities and 33 per cent bonds. In addition, there is a precious metal component of three per cent in the form of silver. The remaining 14 per cent of the assets are invested in the money market. In terms of product allocation, Sutor Bank focuses primarily on individual securities (47 per cent), followed by ETFs (37 per cent). Sutor Bank spreads risk widely across different regions and sectors. It invests in small and medium-sized enterprises.

The performance of the recommendations over the past ten years served as the basis for calculating the probability of possible portfolio values in three years. The result at Sutor Bank: there is a 38 per cent probability of achieving a return of 18 per cent.

Mathias Beil, Head of Private Banking at Sutor Bank, emphasises the importance of calm portfolio management in turbulent times: "Our investment principles are clear: we remain invested even in turbulent times and do not act rashly. Our clients take this to heart. So it's no wonder that there was neither panic nor a change in strategy. They kept themselves informed and remained level-headed thanks to our advice," explains Beil.

Precious metals such as gold and silver experienced a real boom this year. Mathias Beil is convinced that this development will continue in the long term and sees further upside potential, especially for silver: ‘Silver is catching up significantly with gold. After years of relative undervaluation, there are many indications that the historical balance between the two precious metals is being restored,’ says Beil. Several factors are contributing to this rise – on the one hand, the US Federal Reserve's pause in interest rate cuts is coming to an end, which typically boosts precious metals. On the other hand, industrial demand for silver is growing. ‘Gold and silver belong in every portfolio,’ explains Mathias Beil.

Mathias Beil believes that political and structural developments are likely to remain dynamic next year. But regardless of whether times are dynamic or calmer, Mathias Beil and his private banking team consider a clear structure and diversification in investment portfolios to be essential.

![[Translate to English:] Deutsche Flagge vor dem Bundestag](/fileadmin/_processed_/6/8/csm_maheshkumar-painam-HF-lFqdOMF8-unsplash_fde0da4c98.webp)