In our asset management, we develop professional investment strategies – with all the know-how of experienced financial experts. The basis for this is the Sutor investment code, which includes 10 simple, scientifically and historically well-secured investment principles for the capital market and for successful asset accumulation.

With us, long-term, serious forms of investment are possible that let investors and consultants sleep peacefully - without wild speculation and unnecessary risks. Our goal is to always provide you with the market return that you can achieve with your individual investor profile. Without unnecessary trading costs or losses from frequent buying or selling reducing this return. That is why all our portfolios are built according to the principles of modern portfolio theory: They diversify investments across stock and bond funds that invest in different classes of companies and geographies. You will look in vain for nested, complicated financial products with us.

By the way: when we talk about money, strategies, opportunities and risks, we speak plain language. It is our concern to present complicated content in a simple and understandable way, and not to speak "banking Chinese".

To our Investing Codex

By private bank we mean your personal bank

At Sutor Bank, we take the ‘private’ in private banking literally: ‘Relating only to oneself, characterised by a personal, familiar atmosphere; informal, relaxed, intimate,’ according to the Duden dictionary. We couldn't describe our relationship with our customers any better ourselves. And we prove our mastery of banking day in, day out with our investment strategies and recommendations.

No wonder, then, that over the years many customers have become friends. Or as Werner Sutor (1915-2004), son of our founder Max Heinrich Sutor, once said about his bank customers: ‘At some point, you no longer know which came first: the customer relationship or the friendship.’ We think in terms of generations, not quarters – just like our customers. On average, our customers have been with Sutor Bank for around 20 years, or one generation.

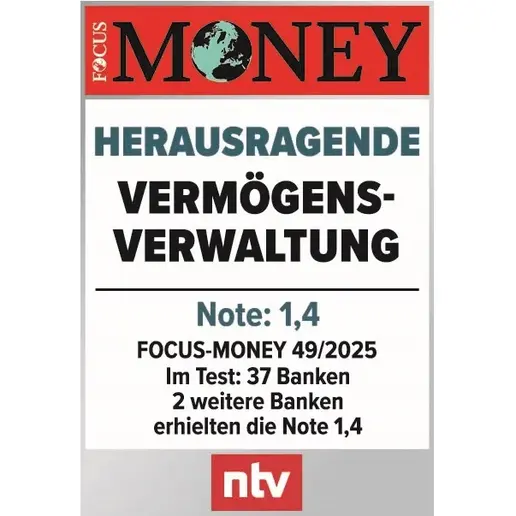

![[Translate to English:] aktuelles IVA-Siegel](/fileadmin/_processed_/2/a/csm_Guetesiegel_63e62e63e2.webp)

![[Translate to English:] Bäume spiegeln sich in moderner Hausfassade](/fileadmin/_processed_/0/0/csm_Baeume-Spiegelung_70c499a543.jpg)