Dividends provide ongoing income, convey stability and are considered an expression of a company's financial strength. From the perspective of Hamburg-based Sutor Bank, dividends are therefore a valuable aid in investment decisions – but not a viable criterion on their own, especially as the discussion about declining dividends has come up repeatedly in recent quarters.

‘Dividends provide important information, but they are no substitute for a comprehensive analysis,’ says Mathias Beil, Head of Private Banking at Sutor Bank. ‘Especially in an environment where the dividend yields of many shares are below the yields of risk-free investments, investors should not only look at the distribution, but also at the business model, earnings power, balance sheet quality and long-term prospects.’

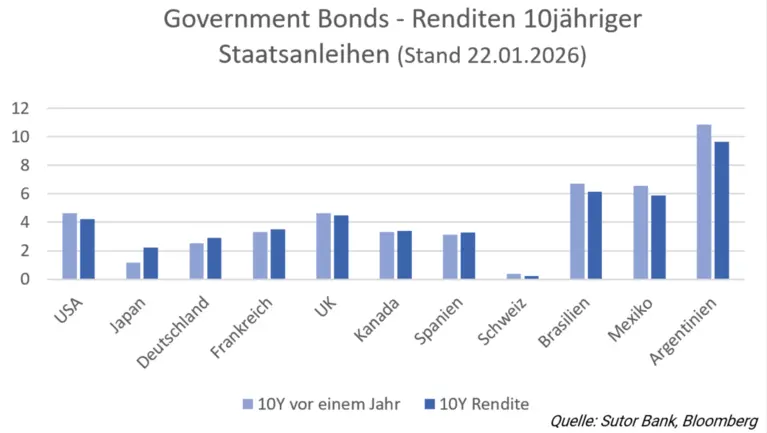

Indeed, current market developments show that dividend yields are currently often lower on the average than the interest rates on government bonds or even money market investments. Nevertheless, dividends remain important – especially as a decision-making tool in an international comparison. And there are attractive opportunities to be found here in Europe, especially in Germany.

DAX: Decline in distributions focused on specific sectors

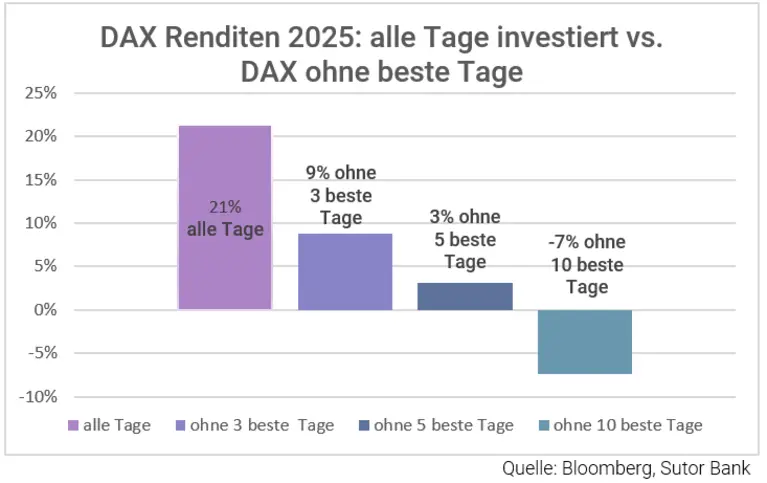

The discussions surrounding the expected and planned dividends of DAX companies for 2026 illustrate this. ‘Although a slight decline in the total amount of distributions is to be expected, this picture is largely influenced by individual sectors,’ says Beil. The majority of DAX companies are planning stable or rising dividends, and total distributions remain at a high level. ‘It is also striking that a significant proportion of companies are expected to generate dividend yields of three per cent or more,’ says Beil. ‘Many German companies have a very reliable distribution policy – regardless of short-term economic fluctuations.’

There are clear differences when compared internationally: while the US stock market has always focused more on capital gains and share buybacks and therefore has lower average dividend yields, Germany, France and Switzerland are noticeably above this. These markets are characterised by a traditionally stronger dividend culture. Companies here often see distributions as an integral part of their capital market strategy.

‘Germany, France and Switzerland offer an interesting environment for investors who use dividends as a guide,’ says Mathias Beil. ‘In the US, the focus is more on share prices. That's neither better nor worse – but it does lead to different return profiles.’ Concepts such as so-called dividend aristocrats also underscore this difference. While very long series of continuous dividend increases are common in the US, the circle of such companies is smaller in Germany. Nevertheless, there are also companies here with remarkable dividend continuity that may be of interest to income-oriented investors.

‘The topic of dividends shows how important diversification across different countries is. From a dividend perspective, Germany should be included in every portfolio,’ summarises Mathias Beil.